The local share market has finished slightly higher but the gains did not come close to keeping it out of the red for the week, with a third-straight monthly decline looming.

The benchmark S&P/ASX200 index on Friday closed up 14.6 points, or 0.21 per cent, to 6,826.9.

The broader All Ordinaries gained 13.1 points, or 0.19 per cent, to 7,014.2.

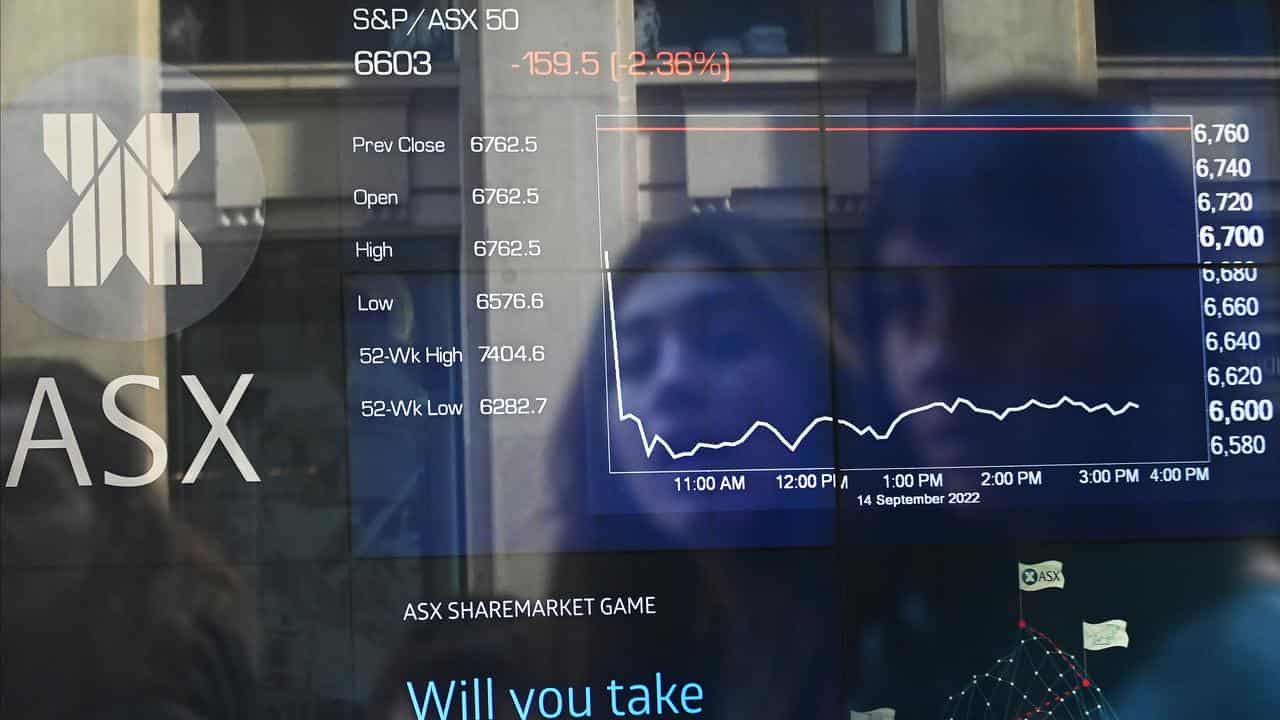

For the week the ASX200 lost 1.1 per cent - its fifth week of losses out of the past six - pressured by higher bond yields, rising interest rate expectations and fears of the war in Gaza becoming a broader Middle Eastern conflict.

The index closed at a one-year low on Thursday and is down 3.2 per cent for the month, with two trading sessions left in October.

"On a day like today, it is normal to get a bit of a bounce back," Eightcap market analyst Zoran Kresovic told AAP.

"And that would predominantly due to traders trying to pick the bottom, because they think the market is bottoming out at the moment."

But, Mr Kresovic cautioned, "the rise today does not by any means indicate that we've actually hit the bottom, because if anything the market is looking quite bearish right now," having this week fallen through a major low set on March 20.

If the ASX200 can't sustain a push up towards its next resistance level of around 6,900 to 7,000, there could be further downside, he said.

Six of the ASX's 11 sectors finished higher on Friday and five closed lower. Consumer staples were the biggest mover, climbing 1.3 per cent as Coles added 2.1 per cent and Endeavour Group rose 3.5 per cent.

All the big retail banks closed higher, with NAB adding 0.7 per cent to $28.40, CBA gaining 0.8 per cent to $97.80, Westpac climbing 0.5 per cent to $20.67 and ANZ finishing up 0.2 per cent at $24.85.

Insurance companies were lower as broker network Steadfast gave what appeared to be a positive quarterly update at its annual general meeting.

Steadfast dropped 4.3 per cent to an eight-month low of $5.35, while Medibank Private fell 2.9 per cent, IAG dropped 1.9 per cent and QBE dipped 1.7 per cent.

The heavyweight mining sector rose 0.6 per cent, bolstered by China's announcement of additional fiscal stimulus measures.

BHP gained 0.3 per cent to $45.06, Fortescue rose 0.2 per cent to $22.25 and South32 added 2.8 per cent to $3.33.

Newmont Corp made its debut on the ASX after the world's biggest goldminer completed its acquisition of Newcrest. The Newmont CDIs finished at $59.50 under the ticker code NEM.

Brambles fell 5.7 per cent to a seven-month low of $13.19 as the global pallet company reconfirmed guidance and announced first-quarter sales growth of 13 per cent, but added that new business wins had been modest.

Harvey Norman grew 4.8 per cent to a 10-day high of $3.72 as the white goods and home retailer announced a $442.3 million share buyback.

It also said that sales had dropped 9.1 per cent in September quarter, with Australian sales down 13.6 per cent.

ResMed dropped 4.0 per cent to $21.56 after the respiratory product device-maker said that margins fell in the first quarter due to battery issue with its Astral ventilators.

The Australian dollar was buying 63.39 US cents, from 62.94 US cents at Thursday's ASX close.

The Federal Reserve will announce its latest decision on interest rates early on Thursday, Australia time.

ON THE ASX:

* The S&P/ASX200 index finished Friday up 14.6 points, or 0.21 per cent, at 6,826.9.

* The All Ordinaries gained 13.1 points, or 0.19 per cent, to 7,014.2

CURRENCY SNAPSHOT:

One Australian dollar buys:

* 63.42 US cents, from 62.94 US cents at Thursday's ASX close

* 95.25 Japanese yen, from 94.79 yen

* 60.07 Euro cents, from 59.70 Euro cents

* 52.32 British pence, from 52.10 pence

* 108.99 NZ cents, from 108.62 NZ cents